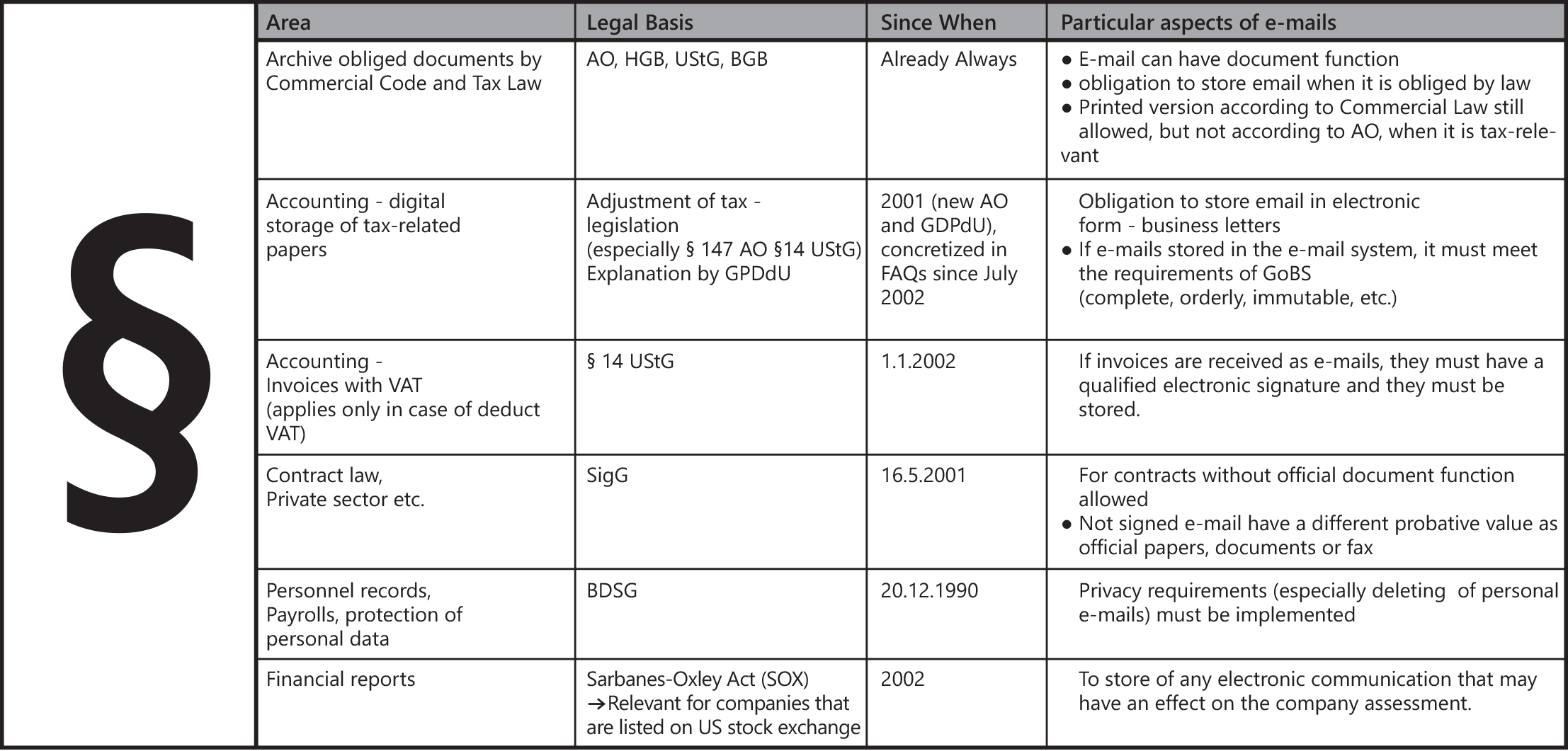

What is the legal relevance of emails and email archiving? Which emails should or must one keep? When do you have a legal obligation to archiving? The rules are cumulative, not alternative. Depending on the case, several rules are activated. Basically the German Tax Law and the Commercial Code are the laws you shouldn’t avoid if you are looking for your obligations by law.

The latest information on the principles of data access and auditing of digital documents and tax codes you can find on the website of the German Federal Ministry of Finance

The latest information on the principles of data access and auditing of digital documents and tax codes you can find on the website of the German Federal Ministry of Finance

(www.bundesfinanzministerium.de).

There is a hint in any case: The emails which contain no taxable content, they do not need to be archived and also they do not need to be kept for data access. However, it is not entirely clear which contents are tax-relevant. If you’re in doubt, it is better to archive more than less! Another indication is based on the German Commercial Code that emails must be archived as digital data or in printed form as well. The tax law requires however archiving on digital media, so it is recommended to archive emails at least in digital form. In addition to legal reasons for the email archiving, there are others, such as contractual obligation but also voluntary archiving. A particular problem during the archiving is the protection of privacy, which is regulated by the Federal Data Protection Act and the Telecommunications Act.

In the email archiving you should not forget mobile devices, because not all company emails must be stored on the server in this case. In this brief overview, you can find some clues to the legal relevance for email archiving in Germany.